Perovskite Photovoltaic Technology Market Report 2025: Unveiling Breakthrough Efficiency, Market Expansion, and Global Opportunities. Explore Key Trends, Forecasts, and Strategic Insights for the Next 3–5 Years.

- Executive Summary & Market Overview

- Key Technology Trends in Perovskite Photovoltaics

- Competitive Landscape and Leading Players

- Market Size, Growth Forecasts & CAGR Analysis (2025–2030)

- Regional Market Analysis & Emerging Hotspots

- Future Outlook: Commercialization Pathways and Adoption Scenarios

- Challenges, Risks, and Strategic Opportunities

- Sources & References

Executive Summary & Market Overview

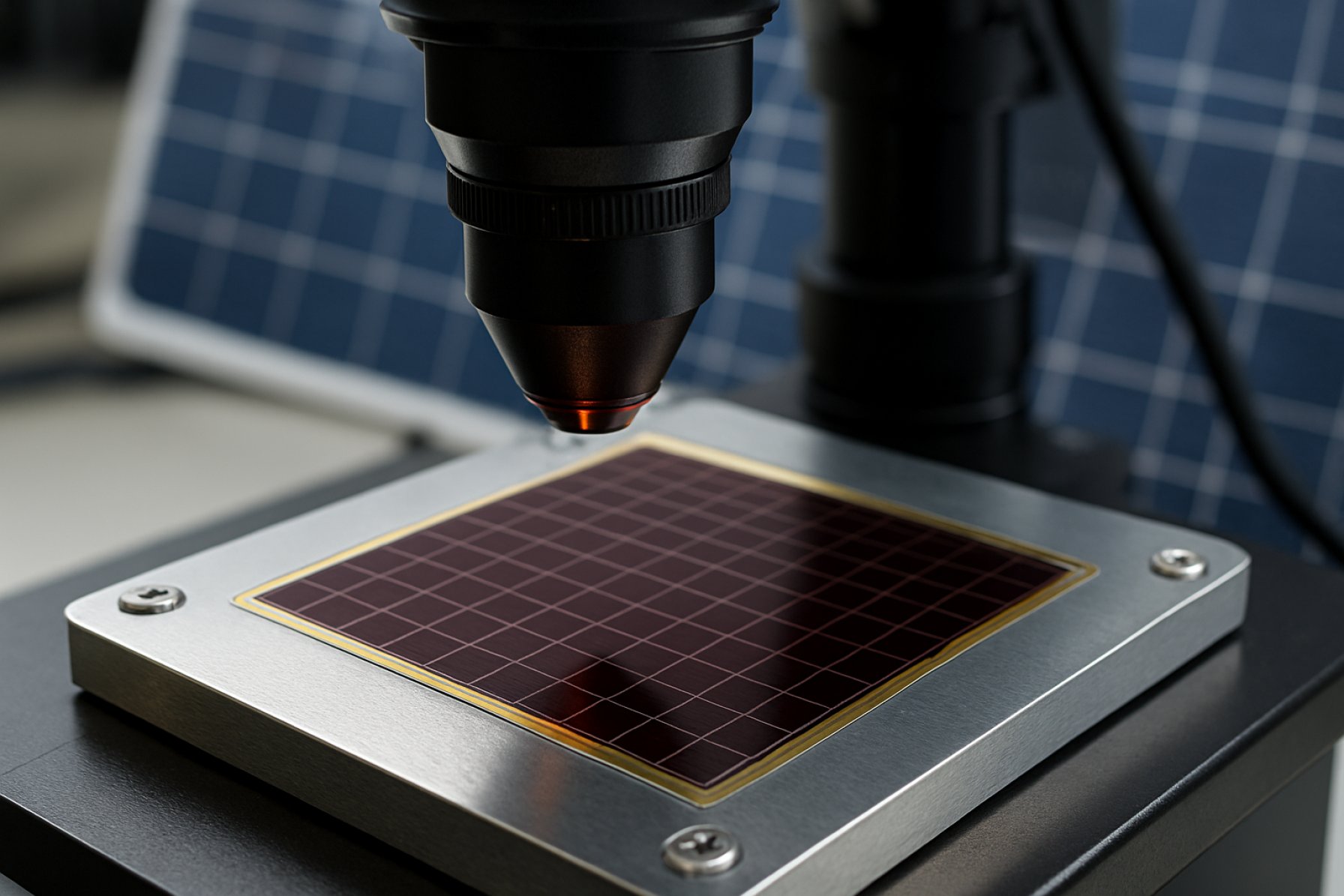

Perovskite photovoltaic technology represents a transformative advancement in the solar energy sector, leveraging the unique properties of perovskite-structured materials to achieve high power conversion efficiencies at potentially lower manufacturing costs compared to traditional silicon-based photovoltaics. As of 2025, the global perovskite solar cell (PSC) market is experiencing accelerated growth, driven by ongoing research breakthroughs, increased investment, and the urgent demand for scalable, sustainable energy solutions.

Perovskite solar cells have rapidly advanced from laboratory prototypes to pilot-scale production, with certified power conversion efficiencies surpassing 25%—a figure that rivals and, in some cases, exceeds that of established silicon technologies. This progress is underpinned by the material’s tunable bandgap, solution-processability, and compatibility with flexible substrates, enabling novel applications such as building-integrated photovoltaics (BIPV) and lightweight, portable solar panels. According to International Energy Agency, the global solar PV market is projected to expand at a compound annual growth rate (CAGR) of over 8% through 2030, with perovskite technologies expected to capture a growing share of new installations.

Key industry players—including Oxford PV, Saule Technologies, and Microquanta Semiconductor—are scaling up production and targeting commercial deployment in both standalone and tandem cell configurations. Strategic partnerships between research institutions and manufacturers are accelerating the transition from R&D to commercialization, with pilot lines and demonstration projects underway in Europe, Asia, and North America.

Despite these advances, the market faces challenges related to long-term stability, lead content, and large-scale manufacturability. However, ongoing innovation in encapsulation, material engineering, and recycling is addressing these concerns, with several companies reporting significant improvements in operational lifetimes and environmental safety. Regulatory support and funding initiatives from entities such as the European Commission and U.S. Department of Energy are further catalyzing market development.

In summary, perovskite photovoltaic technology is poised to disrupt the global solar market in 2025, offering a compelling combination of efficiency, versatility, and cost-effectiveness. The next 12–24 months will be critical as the industry moves from pilot-scale validation to mass-market adoption, with significant implications for the renewable energy landscape worldwide.

Key Technology Trends in Perovskite Photovoltaics

Perovskite photovoltaic technology is rapidly evolving, with 2025 poised to be a pivotal year for both research breakthroughs and commercial advancements. Perovskite solar cells (PSCs) are distinguished by their unique crystal structure, which enables high light absorption, tunable bandgaps, and low-cost fabrication. The following key technology trends are shaping the perovskite photovoltaics landscape in 2025:

- Stability Improvements: Historically, perovskite solar cells have faced challenges related to long-term operational stability, particularly under heat, moisture, and UV exposure. In 2025, significant progress is being made through compositional engineering—such as the incorporation of mixed cations and halides—and advanced encapsulation techniques. These innovations are extending device lifetimes to over 25 years, approaching the durability of traditional silicon photovoltaics (National Renewable Energy Laboratory).

- Efficiency Milestones: Laboratory-scale perovskite cells have surpassed 26% power conversion efficiency, rivaling and even exceeding some silicon-based cells. Tandem architectures, which stack perovskite layers atop silicon or other materials, are pushing combined efficiencies beyond 30%. These advances are being translated into larger modules, with pilot production lines demonstrating scalable, high-efficiency panels (Oxford PV).

- Manufacturing Scale-Up: In 2025, roll-to-roll printing and slot-die coating are emerging as leading scalable manufacturing methods, enabling low-cost, high-throughput production of perovskite modules. Companies are investing in gigawatt-scale facilities, with the first commercial perovskite module lines coming online in Europe and Asia (Heliatek).

- Lead-Free and Eco-Friendly Materials: Environmental concerns over lead content in perovskite formulations are driving research into lead-free alternatives, such as tin-based perovskites. While these alternatives currently lag in efficiency and stability, 2025 is seeing incremental improvements, with several startups announcing prototype modules (imec).

- Integration and Application Expansion: Flexible, lightweight perovskite modules are being integrated into building-integrated photovoltaics (BIPV), portable electronics, and even vehicle surfaces. Their tunable transparency and color are opening new design possibilities for architects and product designers (Solaronix).

These technology trends collectively signal a transition from laboratory innovation to real-world deployment, positioning perovskite photovoltaics as a disruptive force in the global solar market in 2025.

Competitive Landscape and Leading Players

The competitive landscape of the perovskite photovoltaic (PV) technology market in 2025 is characterized by rapid innovation, strategic partnerships, and increasing investments from both established solar companies and specialized startups. As perovskite solar cells (PSCs) approach commercial viability, the sector is witnessing intensified competition to achieve higher efficiencies, longer lifespans, and scalable manufacturing processes.

Leading the charge are companies such as Oxford PV, which has made significant strides in tandem silicon-perovskite cells, achieving record-breaking efficiencies and targeting mass production at its German facility. Saule Technologies is another prominent player, focusing on flexible and lightweight perovskite modules for building-integrated photovoltaics (BIPV) and IoT applications. Microquanta Semiconductor in China is scaling up pilot production lines and has demonstrated notable progress in large-area perovskite modules.

Major traditional solar manufacturers are also entering the perovskite space. Hanwha Solutions and JinkoSolar have announced R&D initiatives and collaborations aimed at integrating perovskite layers with existing silicon technologies, seeking to leverage their established supply chains and market reach. Meanwhile, First Solar has invested in research partnerships to explore tandem architectures, although its primary focus remains on thin-film cadmium telluride.

The competitive dynamics are further shaped by academic spin-offs and consortia, such as the Heliatek and the Global Perovskite Initiative, which foster collaboration between research institutions and industry. These entities are crucial in addressing technical challenges like stability, lead toxicity, and upscaling.

- Wood Mackenzie projects that by 2025, the first commercial perovskite modules will enter niche markets, with broader adoption expected as durability and cost targets are met.

- Venture capital and government funding are accelerating, with the U.S. Department of Energy and the European Commission supporting pilot projects and scale-up efforts.

In summary, the 2025 perovskite PV market is defined by a mix of agile startups, established solar giants, and collaborative research networks, all vying to capture early market share and set industry standards as the technology matures.

Market Size, Growth Forecasts & CAGR Analysis (2025–2030)

The global perovskite photovoltaic (PV) technology market is poised for significant expansion between 2025 and 2030, driven by rapid advancements in material science, increasing investments, and the urgent need for cost-effective renewable energy solutions. In 2025, the market size for perovskite PV is projected to reach approximately USD 1.2 billion, reflecting early-stage commercialization and pilot-scale deployments across key regions such as Europe, Asia-Pacific, and North America (IDTechEx).

From 2025 to 2030, the perovskite PV market is expected to register a compound annual growth rate (CAGR) exceeding 30%, outpacing traditional silicon-based solar technologies. This robust growth is attributed to several factors:

- Efficiency Gains: Ongoing R&D is pushing perovskite cell efficiencies beyond 25%, narrowing the gap with established silicon PV and attracting commercial interest (National Renewable Energy Laboratory).

- Manufacturing Scalability: The ability to produce perovskite modules using low-cost, scalable processes such as roll-to-roll printing is expected to drive down costs and enable mass production by late 2020s (International Energy Agency).

- Investment Surge: Venture capital and government funding for perovskite startups and pilot lines have increased sharply, with Europe and China leading in demonstration projects and early market adoption (U.S. Department of Energy).

By 2030, market analysts forecast the global perovskite PV market could surpass USD 5.5 billion, with Asia-Pacific accounting for the largest share due to aggressive solar deployment targets and manufacturing capacity. Europe is expected to follow, driven by strong policy support and innovation funding. The market’s CAGR, estimated between 30% and 35% for the 2025–2030 period, underscores the disruptive potential of perovskite technology in the broader solar PV landscape (MarketsandMarkets).

Despite this optimistic outlook, the market’s trajectory will depend on overcoming challenges related to long-term stability, environmental safety, and large-scale manufacturing. Nevertheless, the anticipated growth rates and market size projections highlight perovskite PV’s emergence as a transformative force in the global renewable energy sector.

Regional Market Analysis & Emerging Hotspots

The regional market landscape for perovskite photovoltaic (PV) technology in 2025 is characterized by dynamic growth, with several emerging hotspots driven by policy support, R&D investments, and manufacturing scale-up. Asia-Pacific, Europe, and North America are at the forefront, but new players in the Middle East and Latin America are also gaining traction.

Asia-Pacific remains the dominant region, propelled by China’s aggressive investments in next-generation solar technologies. Chinese firms, supported by government initiatives such as the “14th Five-Year Plan for Renewable Energy,” are rapidly scaling pilot lines and commercial production of perovskite modules. Notably, GCL System Integration Technology and Microquanta Semiconductor have announced multi-hundred-megawatt perovskite manufacturing facilities, aiming for mass-market deployment by 2025. Japan and South Korea are also investing in perovskite R&D, with companies like Toray Industries and Hanwha Solutions focusing on tandem cell integration and flexible PV applications.

Europe is emerging as a key innovation hub, driven by the European Union’s Green Deal and the REPowerEU plan, which prioritize domestic solar manufacturing and energy security. The Heliatek and Oxford PV are leading commercialization efforts, with Oxford PV’s perovskite-silicon tandem cells targeting gigawatt-scale production in Germany. The region’s focus on sustainability and circular economy principles is fostering the development of lead-free and recyclable perovskite materials, positioning Europe as a leader in eco-friendly PV solutions.

- North America is witnessing increased venture capital and government funding, particularly in the United States. The U.S. Department of Energy has launched initiatives to accelerate perovskite commercialization, supporting startups like EnergyX and Tandem PV. The region’s focus is on high-efficiency modules for residential and commercial markets, as well as integration with building materials.

- Middle East and Latin America are emerging as new hotspots, leveraging abundant solar resources and favorable policy frameworks. Saudi Arabia’s KAUST and Brazil’s CNPq are investing in perovskite research, aiming to localize production and reduce solar energy costs.

In summary, 2025 will see perovskite PV technology transitioning from lab-scale breakthroughs to regional commercialization, with Asia-Pacific and Europe leading, and new growth centers emerging globally as the technology matures and supply chains localize.

Future Outlook: Commercialization Pathways and Adoption Scenarios

As perovskite photovoltaic (PV) technology advances toward commercial viability, 2025 is poised to be a pivotal year for its market trajectory. The future outlook for perovskite PV commercialization is shaped by rapid improvements in efficiency, scalability, and stability, as well as evolving regulatory and investment landscapes. Several commercialization pathways are emerging, each with distinct adoption scenarios and market implications.

One prominent pathway is the integration of perovskite layers with existing silicon solar cells to create tandem modules. This approach leverages the established manufacturing infrastructure of silicon PV while boosting overall efficiency. Leading companies such as Oxford PV are targeting commercial-scale production of perovskite-silicon tandem cells, with pilot lines expected to ramp up in 2025. This hybridization is anticipated to accelerate market entry by mitigating reliability concerns and capitalizing on silicon’s proven track record.

Another pathway involves the development of all-perovskite modules, which promise lower production costs and greater flexibility in form factors. However, these modules face more significant challenges in terms of long-term stability and large-scale manufacturing. Startups and research consortia, including the National Renewable Energy Laboratory (NREL), are actively working to address these hurdles, with field trials and demonstration projects scheduled for 2025.

Adoption scenarios for perovskite PV in 2025 will likely be segmented by application. Building-integrated photovoltaics (BIPV), portable electronics, and niche off-grid markets are expected to be early adopters, capitalizing on perovskites’ lightweight and semi-transparent properties. According to Wood Mackenzie, commercial rooftop and utility-scale deployments will follow as bankability improves and certification standards are met.

- Short-term (2025-2027): Expect limited but high-profile commercial installations, primarily in tandem configurations and specialty applications. Partnerships between perovskite innovators and established PV manufacturers will be crucial.

- Mid-term (2028-2030): Broader adoption in mainstream solar markets as reliability data accumulates and cost advantages are realized. All-perovskite modules may begin to compete directly with silicon.

Overall, the commercialization of perovskite PV technology in 2025 will be characterized by strategic collaborations, incremental market entry, and a focus on applications that leverage perovskites’ unique attributes. The pace of adoption will depend on continued progress in durability, scale-up, and regulatory acceptance, with the potential to disrupt the global solar market in the coming decade.

Challenges, Risks, and Strategic Opportunities

Perovskite photovoltaic technology, while promising for its high efficiency and low-cost manufacturing potential, faces a complex landscape of challenges, risks, and strategic opportunities as it approaches commercial maturity in 2025. The most pressing challenge remains the long-term stability of perovskite solar cells. Unlike traditional silicon-based photovoltaics, perovskite materials are highly sensitive to moisture, oxygen, heat, and ultraviolet light, leading to rapid degradation and performance loss. This instability has hindered large-scale deployment and raised concerns among investors and end-users regarding product reliability and warranty periods. Recent research and pilot projects have demonstrated incremental improvements in encapsulation and material engineering, but achieving the 25-30 year operational lifespans expected in the solar industry remains a significant hurdle National Renewable Energy Laboratory.

Another risk is the scalability of manufacturing processes. While perovskite cells can be produced using low-temperature solution processing, scaling these methods to gigawatt-level production without sacrificing uniformity or efficiency is unproven at commercial scale. Additionally, the use of lead in most high-efficiency perovskite formulations presents environmental and regulatory risks. Although research into lead-free alternatives is ongoing, these have yet to match the performance of their lead-based counterparts International Energy Agency.

Despite these challenges, strategic opportunities abound. Perovskite technology’s compatibility with flexible substrates and potential for tandem integration with silicon cells could enable new product categories, such as lightweight, semi-transparent, or building-integrated photovoltaics. This opens doors to markets that are less accessible to conventional solar panels, including urban infrastructure and portable power applications. Furthermore, the rapid pace of efficiency improvements—perovskite cells have surpassed 25% in laboratory settings—positions the technology as a strong candidate for next-generation solar modules National Renewable Energy Laboratory.

- Strategic partnerships between perovskite startups and established solar manufacturers are accelerating pilot production and field testing.

- Government and private funding are increasingly directed toward overcoming stability and toxicity issues, with several demonstration projects slated for 2025.

- Early-mover advantage exists for companies that can secure intellectual property and establish robust supply chains for perovskite-specific materials.

In summary, while perovskite photovoltaic technology faces significant technical and regulatory risks, its disruptive potential and expanding application landscape present compelling strategic opportunities for innovators and investors in 2025.

Sources & References

- International Energy Agency

- Oxford PV

- Saule Technologies

- Microquanta Semiconductor

- European Commission

- National Renewable Energy Laboratory

- Heliatek

- imec

- Solaronix

- JinkoSolar

- First Solar

- Heliatek

- Wood Mackenzie

- IDTechEx

- MarketsandMarkets

- EnergyX

- Tandem PV

- KAUST

- CNPq