Vzostup MAMA: Advocacy za bezpečnejšie detstvo

Julie Scelfo, bývalá novinárka, založila MAMA — Matky proti závislosti na médiách — ako reakciu na znepokojivé účinky sociálnych médií na duševné zdravie mládeže. Cieľom MAMA je chrániť deti pred všadeprítomným vplyvom technológie a organizácia sa rýchlo rozširuje, má 28 pobočiek v 17 štátoch a mnoho ďalších čaká na založenie. Scelfo zdôrazňuje urgentnú potrebu vzdelávania v oblasti technológie v rodičovstve a podporuje školy, aby ostali bezsmartfónové.

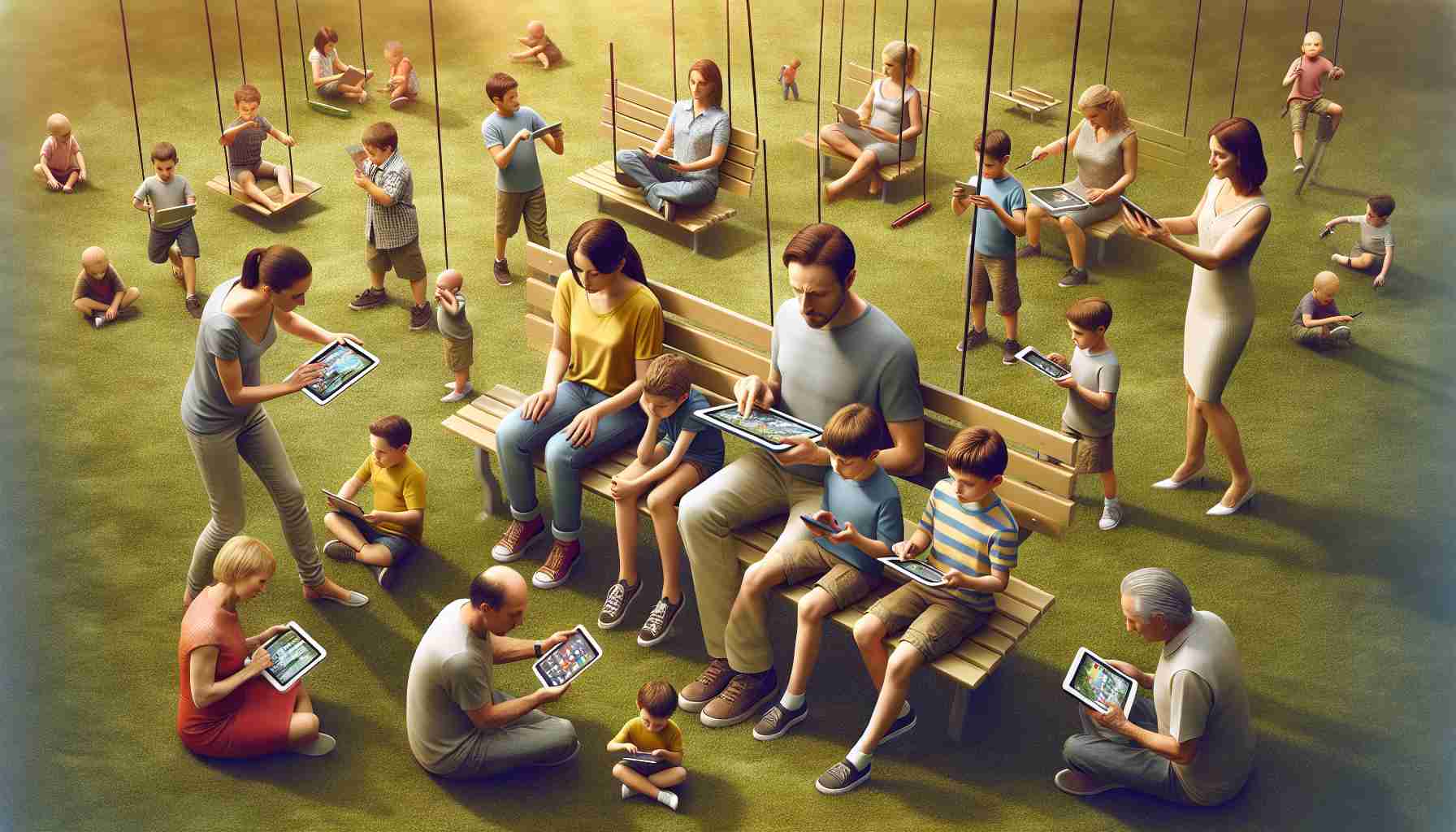

Upozorňuje na vážne obavy rodičov, ktorí sa cítia zahltení všadeprítomnosťou technológie v životoch svojich detí. Úzkosť pramení z tlakovej spoločenskej normy, aby deti vlastnili zariadenia, a z znepokojúceho trendu mladých detí, ktoré používajú tablety v triedach. Rodičia hlásia kolektívnu ťažkosť povzbudzovať vonkajšie hry namiesto času pred obrazovkou vo svete, kde spoločnosti sociálnych médií zneužívajú emócie detí na zisk.

Nedávna legislatíva v Austrálii, ktorá zakazuje používanie sociálnych médií pre tých, ktorí majú menej ako 16 rokov, vyvolala debatu o zodpovednosti vlády. Scelfo tvrdí, že takéto opatrenia by mali držať technologické spoločnosti zodpovedné, namiesto toho, aby bola zodpovednosť iba na rodičoch. Táto legislatíva predstavuje kritický krok smerom k komplexnej regulácii a zdôrazňuje urgentnú potrebu intervencií, ktoré uprednostňujú bezpečnosť detí pred záujmami korporácií.

Konečným cieľom MAMA je zrkadliť snahy viditeľné v obhajobe proti iným spoločenským nebezpečenstvám — prekalibrovať technológiu z centrálneho bodu v životoch detí na podporný nástroj v ich vývoji.

Chápeme dopad: Kritická úloha MAMA v formovaní digitálnych skúseností detí

Úvod do MAMA

Matky proti závislosti na médiách (MAMA) boli založené Julie Scelfo ako iniciatíva zameraná na boj proti negatívnym vplyvom technológie a sociálnych médií na deti. Táto organizácia si uvedomuje rastúce obavy rodičov o duševné zdravie, sociálne zručnosti a celkovú pohodu svojich detí v technologicky orientovanom svete.

Vlastnosti MAMA

– Národný dosah: Od svojho vzniku sa MAMA rozrástla na 28 pobočiek v 17 štátoch, pričom pokračujú úsilie o založenie ďalších. Tento rast odráža široké obavy medzi rodičmi týkajúce sa vplyvu médií na mládež.

– Advocacy za prostredia bez obrazoviek: MAMA podporuje myšlienku bezsmartfónových škôl, aby povzbudila deti k voľnejšiemu zapájaniu sa so svojimi rovesníkmi a k účasti na vonkajších aktivitách bez rozptýlenia zariadeniami.

Prípadové štúdie MAMA

1. Podpora pre rodičov: MAMA poskytuje zdroje a podporu pre rodičov, ktorí majú problémy s riadením technológie vo svojich domácnostiach, ponúkajúc stratégie na zníženie času stráveného pred obrazovkou a podporu zdravších návykov.

2. Workshopy pre komunitu: Organizácia organizuje workshopy zamerané na vzdelávanie rodičov o účinkoch médií na vývoj detí a podporu otvorených diskusií o vytváraní bezpečnejších technologických prostredí.

Obmedzenia technológie v detstve

Aj keď technológia môže ponúknuť výhody ako vzdelávacie aplikácie a online vzdelávacie zdroje, jej nadmerné používanie môže viesť k niekoľkým problémom, vrátane:

– Sociálna izolácia: Zvýšený čas strávený pred obrazovkou môže spôsobiť, že deti sa odpoja od osobných sociálnych interakcií.

– Problémy s duševným zdravím: Výskum naznačuje súvislosť medzi nadmerným používaním sociálnych médií a úzkosťou, depresiou a nízkym sebavedomím mládeže.

Kontroverzie okolo regulácie sociálnych médií

Nedávna legislatíva v Austrálii, ktorá zakazuje prístup k sociálnym médiám pre jednotlivcov mladších ako 16 rokov, vyvolala vášnivé diskusie o digitálnej regulácii. Kritici tvrdia, že tieto zákony by sa mali zamerať na zodpovednosť technologických spoločností za ich vplyv na deti, namiesto toho, aby preťažovali rodičov. Táto debata zdôrazňuje potrebu spoluprácnych prístupov na ochranu duševného zdravia detí.

Pohľady do budúcnosti technológie a detstva

– Predpovede: S rastúcim advocacy za bezpečnejšie používanie technológie je pravdepodobné, že ďalšie štáty budú tlačiť na regulácie na ochranu detí pred škodlivými online vplyvmi.

– Trendy: Trend smerom k znižovaniu času pred obrazovkou v vzdelávacích prostrediach môže viesť k obnoveniu tradičného hrania a vzdelávacích metód, pričom sa kladie dôraz na interpersonálne zručnosti pred digitálnou interakciou.

Klady a zápory prístupu MAMA

Klady:

– Podporuje zdravšie prostredia pre deti.

– Vzdeláva rodičov o vplyve technológie.

– Povzbudzuje zapojenie komunity a podporu.

Zápory:

– Niektorí môžu argumentovať, že obmedzovanie technológie by mohlo brániť učebným príležitostiam detí.

– Vyváženie používania technológie s modernými vzdelávacími metódami môže byť výzvou.

Bezpečnostné aspekty

MAMA zdôrazňuje dôležitosť nielen rodičovského vedenia, ale aj potrebu vzdelávania v oblasti digitálnej gramotnosti v školách. Učenie detí o online bezpečnosti a zodpovednom používaní internetu môže ďalej pomôcť pri orientácii v digitálnom prostredí.

Záver

MAMA je v prednej línii dôležitého hnutia, ktorého cieľom je uprednostniť duševné a emocionálne zdravie detí v čoraz digitálnejšom svete. Ako tlak na bezpečnejšie detstvo pokračuje, diskusia okolo úlohy technológie vo vzdelaní a rodičovstve sa pravdepodobne vyvinie, pričom odráža prebiehajúcu rovnováhu medzi prijímaním inovácií a ochranou zraniteľnej mládeže.

Pre viac informácií navštívte oficiálnu webovú stránku MAMA.