Legislation Aims to Create Distraction-Free Schools

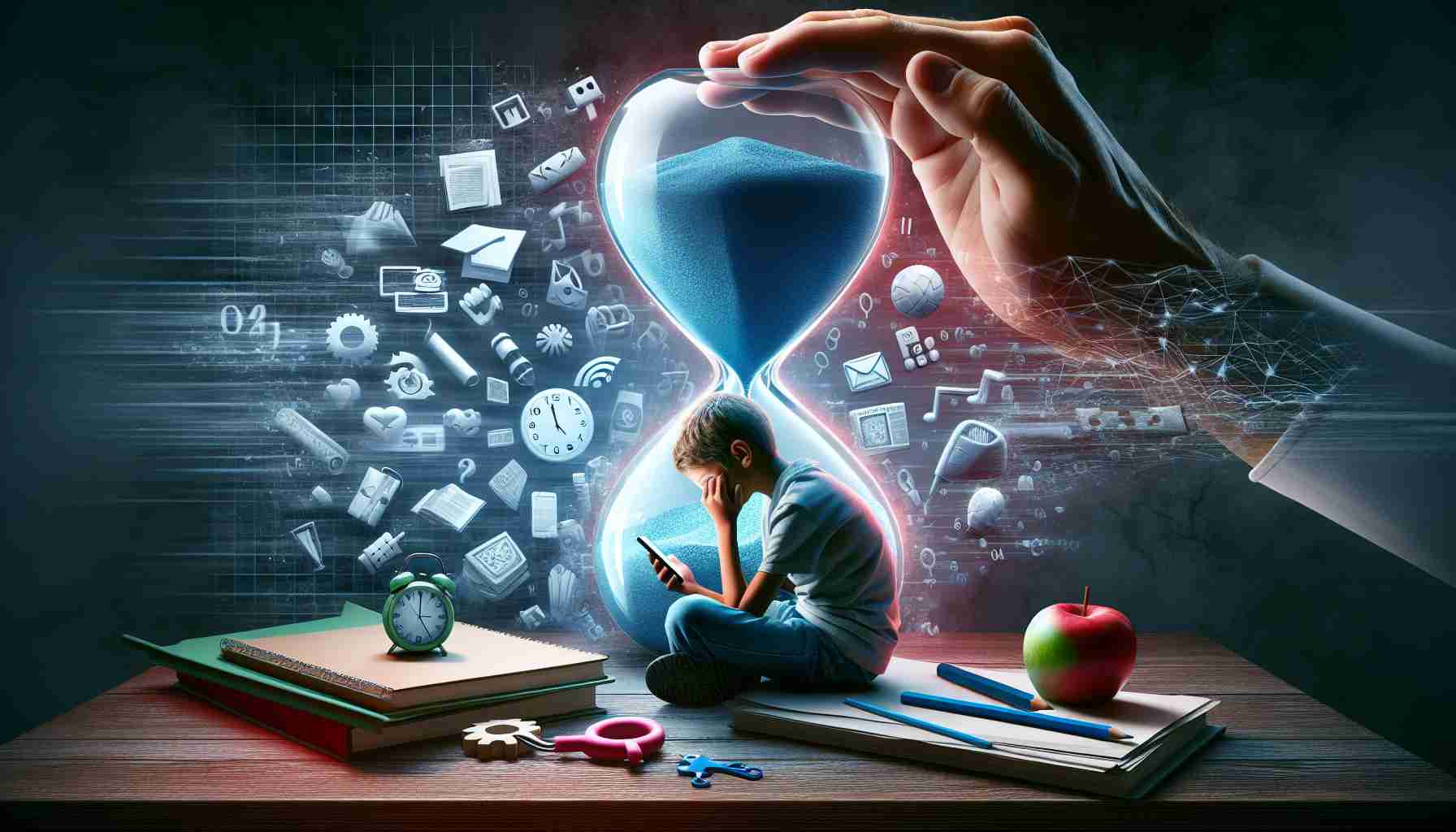

In a bold move to tackle growing concerns over smartphone usage in schools, Governor Kathy Hochul has introduced legislation intended to restrict students from using smartphones and other connected devices during school hours. Advocates are rallying behind this initiative, emphasizing the urgent need to liberate children from the pervasive distractions these devices pose.

Research indicates that excessive screen time disrupts learning and interferes with social interactions among peers. Issues like bullying and decreased engagement in extracurricular activities, such as sports or music, have also emerged as students spend more time staring at screens instead of cultivating real-world relationships.

Hochul’s proposal envisions a comprehensive ban not only within classrooms but also in hallways, cafeterias, and on playgrounds. This approach allows each school district to determine the best methods for managing device storage throughout the day, ensuring local needs are addressed. To support schools in this effort, the state will allocate $13.5 million.

Despite concerns expressed by parents about emergency communications, the legislation mandates schools to establish communication channels for parents to reach students if necessary. Moreover, exceptions will be made for students who require devices for medical conditions or educational support.

The overarching goal of this initiative is to foster an environment where children can engage deeply with their education and peers, steering them away from the isolating grips of technology. In a world inundated with devices, this legislation seeks to restore balance in young people’s lives.

The Broader Impact of Distraction-Free School Policies

As Governor Kathy Hochul’s recent initiative to create distraction-free schools unfolds, its implications stretch beyond the classroom walls, penetrating the fabric of society, culture, and the economy at large. In a time when technology has irrevocably changed our interactions, this legislation raises critical questions about the balance between innovation and interpersonal connection.

The immediate impact on students could be profound. By decreasing screen time, the potential for enhanced academic performance and improved mental health becomes more tangible. Studies have shown that significant reductions in smartphone usage correlate with elevated levels of academic engagement and lower rates of anxiety. Children who engage more in face-to-face interactions are likely to develop stronger social skills and resilience, which are essential in an increasingly complex world.

From a cultural perspective, this policy may signify a shift in how society values digital connectivity versus personal relationships. Schools could become incubators of a generation that prioritizes emotional intelligence and collaborative skills, laying the groundwork for a workforce adept at teamwork and creative problem-solving.

On a macroeconomic scale, reducing digital distraction can improve workforce readiness and productivity. Young adults trained in environments that encourage interpersonal skills and critical thinking may transition more effectively into roles that demand creativity and innovation, driving future economic growth.

Potential environmental ramifications are also worth noting. With less reliance on digital devices, schools may see a reduction in electronic waste and resource consumption, contributing positively to sustainability efforts. As society grapples with rapid technological advancement, Hochul’s initiative could be seen as a necessary recalibration toward a healthier ecological footprint.

Ultimately, as this legislation potentially reshapes educational environments, we may witness a profound re-evaluation of how technology integrates into daily life, fostering a future that values direct human connection amid an ever-evolving digital landscape.

Revolutionizing Education: How New Legislation Aims for Distraction-Free Schools

Legislation Aims to Create Distraction-Free Schools

In a proactive step toward enhancing educational environments, New York Governor Kathy Hochul has introduced ground-breaking legislation designed to mitigate the distractions caused by smartphone and connected device usage in schools. This initiative is gaining traction among advocates who emphasize the urgent need for children to focus on their education and social development without the interruptions these technologies often bring.

Research Insights

Recent studies have shown that excessive smartphone use can severely disrupt learning processes, leading to significant declines in academic performance. The impact extends beyond the classroom; students often experience reduced social interactions, which can contribute to issues like bullying and disengagement from extracurricular activities, including sports and arts. By addressing these concerns, the legislation aims to empower students to foster meaningful relationships and fully participate in their educational journey.

Key Features of the Legislation

The proposed framework calls for a comprehensive ban on smartphones not just within classrooms but also in hallways, cafeterias, and playgrounds. This expansive strategy allows individual school districts the flexibility to devise localized solutions for managing device storage throughout the school day.

To facilitate this transition, the state plans to allocate $13.5 million in funding to assist schools in implementing necessary changes. This investment underscores a commitment to enhancing student engagement and ensuring that educational institutions tackle the challenges posed by digital distractions.

Managing Concerns

Despite some parents voicing concerns regarding the potential impact on emergency communication, the legislation stipulates the establishment of clear communication channels. These channels will allow parents to reach out to their children during school hours, ensuring that emergency situations are managed effectively. Additionally, there will be provisions for students with medical needs or educational requirements that necessitate device usage.

Proposed Limitations and Innovations

While the initiative is broadly aimed at reducing distractions, it recognizes the importance of technology in education. Schools will be encouraged to explore innovative ways to integrate technology in learning environments responsibly.

Use Cases and Potential Impact

The anticipated improvements could lead to better academic outcomes, improved student mental health, and enhanced social skills as students engage more with their peers and educators. Creating distraction-free zones can allow for deeper learning experiences and foster a culture of collaboration among students.

Market Trends and Future Predictions

As schools across the nation grapple with the effects of digital distractions, this legislation in New York could serve as a model for similar initiatives elsewhere. Over the next few years, we may see a trend toward more regulated technology use in educational settings, leading to improved focus and better academic performance.

Conclusion

The push for distraction-free schools through the proposed legislation by Governor Hochul is a significant step toward reshaping the educational landscape. By prioritizing student engagement and social development over technology distractions, this initiative could pave the way for a healthier, more interactive learning environment.

For more information about the evolving landscape of education policies, visit the U.S. Department of Education.