Приемане на съвременната технология

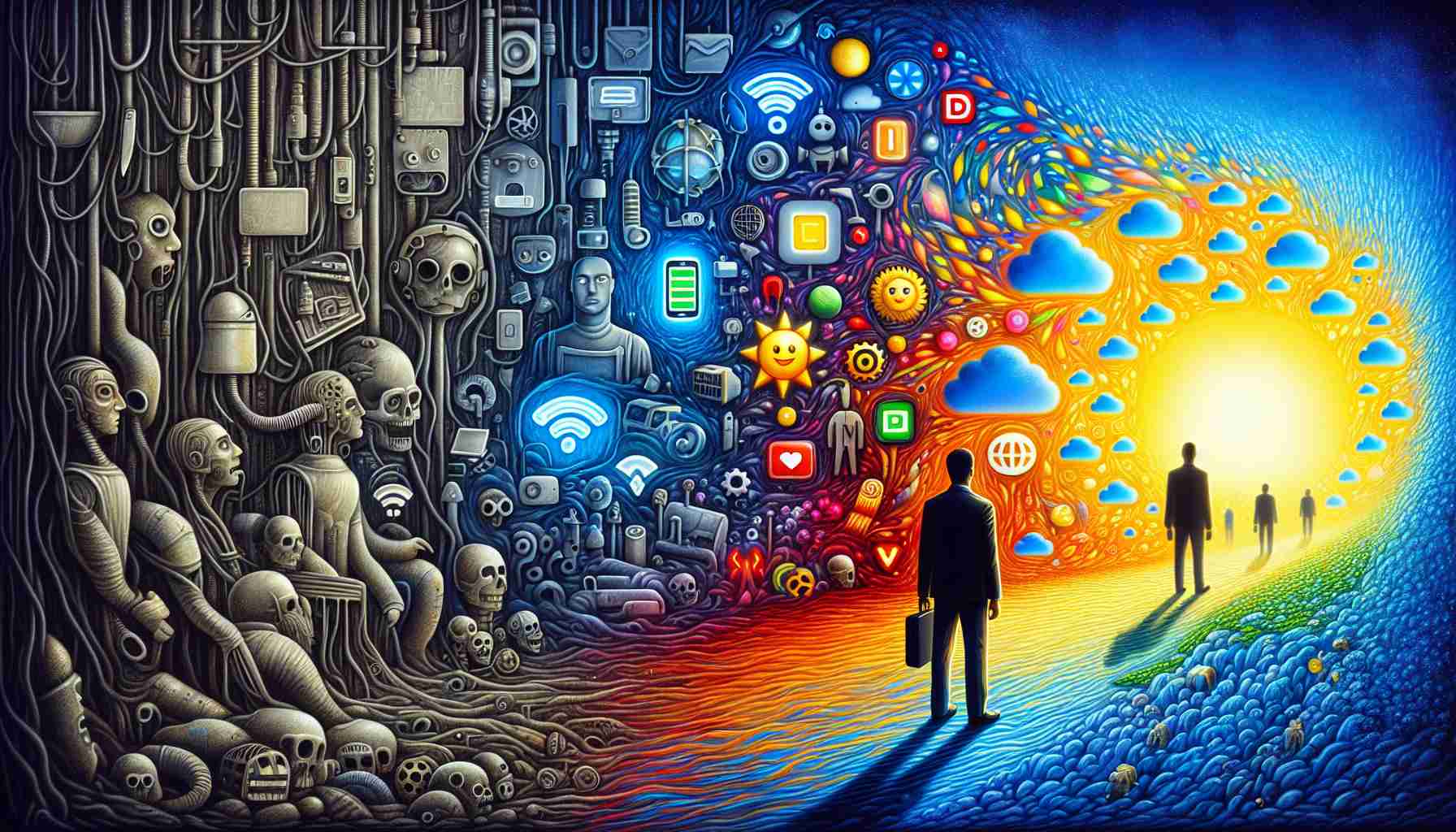

За много възрастни хора преходът към дигиталната ера може да изглежда плашещо. Въпреки това, наскоро преживяно опит с iPod може да промени тази гледна точка. Традиционно, някои индивиди предпочитат простотата на по-старите устройства, считейки, че те са достатъчни. Но, с напредването на технологиите, възможностите за удоволствие и свръзка също нарастват.

Миналата година, изненада за рождения ден от децата – елегантен iPod – разбуди любопитството, въпреки първоначалната неохота. Въпреки че името изглеждаше странно и предизвика мисли за насекоми, те увериха, че ще подобри утринските джогинг сесии. Първоначално успокояващите звуци на природата изглеждаха за предпочитане: птиците пеят, кравите блеят и нежното шумолене на листата.

Въпреки това, както казват, прекалено много спокойствие може да стане монотонно. След известно време се появи желание за нещо по-стимулиращо. Именно тогава идеята да се слуша музика като Metallica сред мирен пейзаж започна да звучи привлекателно.

Правейки още една стъпка в технологичната сфера, регистрацията за акаунт във Facebook отвори нови пътища за свръзка. Въпреки че първоначално изглеждаше като занимание, запазено за по-младите, обещанието да се следят събитията от живота на внуците се оказа неизменимо. Въпреки че намерението може да изглежда банално, истинската радост е в споделените моменти и истории, които технологиите могат да улеснят. Приемането на тези инструменти се оказа освежаващо пътуване на преоткриване.

Цифровият ренесанс за възрастни хора

Интеграцията на технологиите в живота на възрастните хора има силни последици за обществото и културата. С увеличаването на възрастните, които приемат цифрови инструменти, настъпва забележима промяна в разказа за стареенето. Участието в платформи като Facebook или устройства като iPod не само подобрява индивидуалните преживявания

Отворете нови връзки: Как съвременната технология преобразява живота на възрастните хора

Приемане на съвременната технология

Докато навигираме в все по-дигиталния свят, много възрастни хора намират прехода към съвременните технологии за малко объркващ. Въпреки това, последните тенденции показват, че приемането на устройства, като смартфони и таблети, може да доведе до подобрени преживявания и значителна социална свързаност. Научаването за тези технологии предлага многобройни ползи и възможности за възрастни индивиди.

Характеристики на съвременните устройства

Съвременните устройства са проектирани с внимание към потребителската удобство и предлагат по-големи икони и по-прости интерфейси. Например, таблетите позволяват лесен достъп до социални медии, стрийминг услуги и приложения за комуникация, предоставяйки интуитивен начин за взаимодействие с близки и дигиталния свят. Много устройства също идват с функции за достъпност, които отговарят на проблеми с зрението и слуха, правейки технологиите по-включващи.

Приложения: Свързване на поколенията

Една от най-увлекателните причини за възрастните хора да приемат технологиите е възможността да се свързват с по-младите поколения. Платформите за социални медии като Facebook и Instagram предоставят достъп до актуализации на семейството, снимки и споделени спомени. Приложения за видеоповикване като Zoom или Skype улесняват взаимодействията лице в лице, позволявайки на бабите и дядовците да виждат внуците си дори от далеч.

Плюсове и минуси на приемането на технологии

Плюсове:

– Усилена свързаност с семейство и приятели.

– Повишен достъп до информация и развлечения.

– Възможности за учене на нови умения и хобита.

– Инструменти за управление на здравето и благосъстоянието чрез приложения.

Минуси:

– Първоначалната крива на учене може да бъде плашеща.

– Риск от проблеми с поверителността и сигурността.

– Потенциал за чувство на изолация, ако технологиите не се използват правилно.

Сигурност

Докато възрастните хора участват в технологиите, осъзнаването на онлайн сигурността става от съществено значение. Защитата на лична информация чрез силни пароли и разпознаването на фишинг измами е жизненоважно. Много технологични учители предлагат работилници, насочени специално към обучението на възрастни хора как да навигират тези рискове ефективно.

Иновации и тенденции

Настоящите тенденции показват растящо приемане на технологии за умни домове сред възрастните хора, осигурявайки удобство и безопасност. Устройства като умни говорители могат да помагат с напомняния за лекарства, докато системите за умни домове могат да повишат сигурността чрез видеонаблюдение. Иновации в телехартизацията също се появяват, позволявайки на медицинските специалисти да свързват с пациентите си дистанционно, осигурявайки постоянна медицинска грижа.

Анализ на пазара и прозрения

Възрастното население става все по-технологично умно, с милиони възрастни хора, които придобиват смартфони и таблети всяка година. Анализът на пазара показва, че тази демографска група не само консумира съдържание, но и се ангажира с технологиите по иновативни начини, като създаване на блотип или присъединяване към онлайн общности, фокусирани върху хобита и интереси.

Разходи

Въпреки че някои висококачествени устройства могат да изглеждат скъпи, има много опции с бюджет, които не компрометират функционалността. Възрастните хора често могат да намерят лесни за употреба телефони и таблети, проектирани специално за простота и лесна употреба на разумни цени.

Ограничения за запомняне

Въпреки ползите, съществуват определени ограничения. Възрастните хора могат да срещнат предизвикателства с бързо променящата се технология и да се чувстват оставени назад. Освен това, достъпът до надеждни интернет услуги не е универсален, което може да възпрепятства способността да се ангажират напълно с цифровите инструменти.

Прогнози за бъдещото участие

Гледайки в бъдещето, се предвижда тенденцията за интегриране на технологии в ежедневието на възрастните хора да продължи да нараства. Устройствата ще станат още по-интуитивни, а системите за поддръжка, като общностни класове и онлайн уроци, ще процъфтяват, за да помогнат за улесняване на прехода към все по-дигитален начин на живот.

В заключение, пътуването в дигиталната ера може да бъде плашещо за възрастните хора, но наградите от свързаност, учене и участие са забележителни. Чрез приемането на съвременната технология, възрастните хора могат да подобрят живота си и да изградят мостове между поколенията с членове на семейството и приятели.

За повече информация относно влиянието на технологията върху промените в начина на живот, посетете AARP.