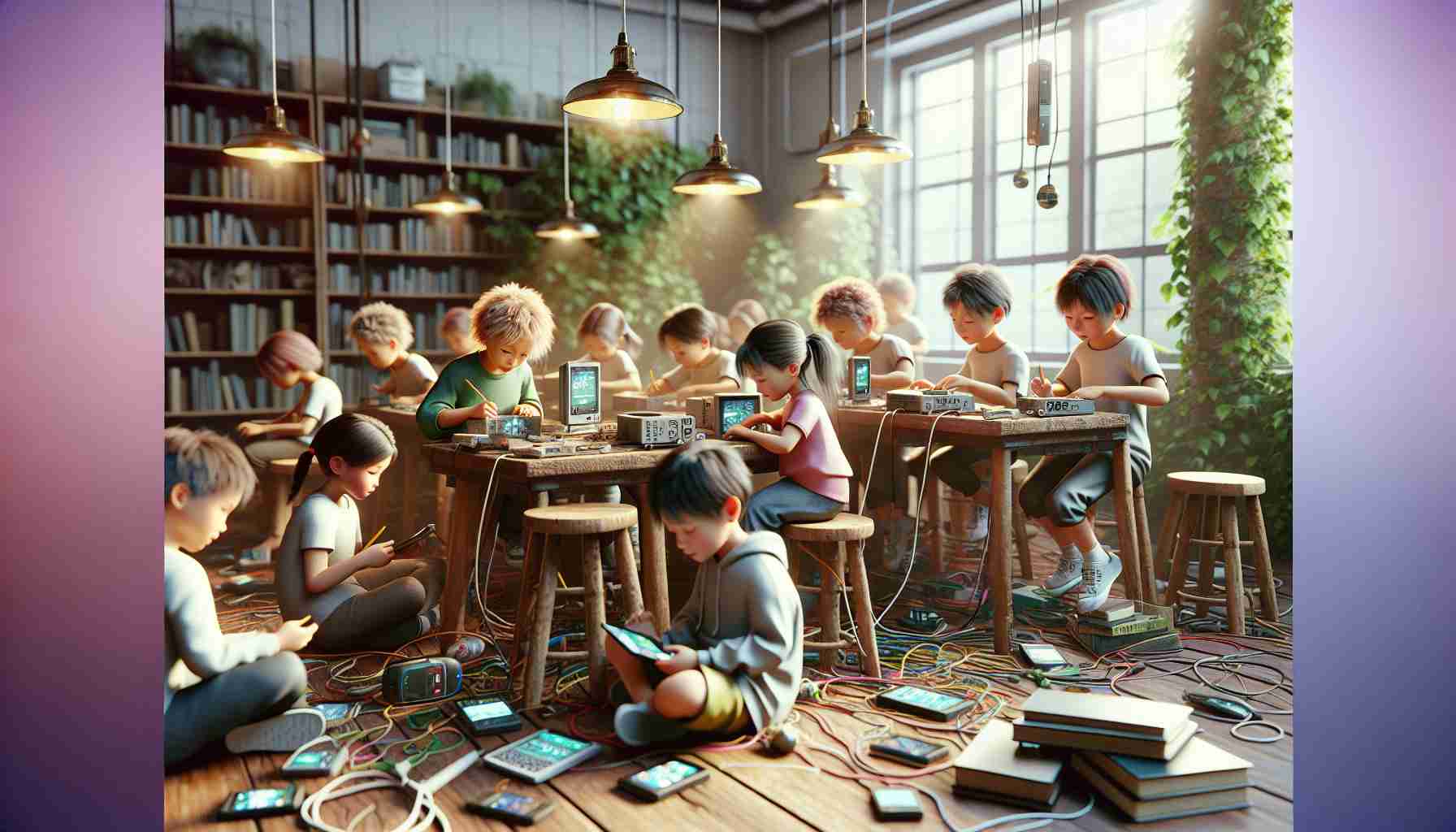

Разбиране на въздействието на технологията върху децата

Boulder Country Day кани общността на важна презентация, която осветява влиянието на технологията върху децата. Събитие е насрочено за 22 януари 2025 г. и ще се проведе от 18:00 до 19:30 ч., като е отворено за всички, безплатно.

Сесията ще представи Ерин Уолш, известен лектор и съосновател на Spark and Stitch Institute. Въз основа на обширния си опит, Уолш е работила с общности в цялата страна, помагайки им да навигират в сложностите на развитието на деца и юноши в ерата на дигитализацията. Чрез своята ангажираща стил, тя прави сложни теми достъпни, насърчавайки задълбочени дискусии сред родители и educators.

Посетителите могат да очакват да разгледат интересни въпроси относно ролята на технологията в подкрепата на социалните връзки или в насърчаването на изолация сред децата. Освен това, Уолш ще сподели най-новите изследвания в областта на мозъчната наука и практическите стратегии, насочени към подобряване на дигиталното благосъстояние на младежи на възраст от 2 до 13 години и по-големи.

Участниците ще получат ценни прозрения относно основните защитни фактори, които могат да помогнат за защита на децата от онлайн рискове, като същевременно развиват техните цифрови умения.

За да си осигурите място на тази просветляваща презентация, се препоръчва регистрация чрез сайта на Boulder Country Day. Присъединете се към нас за вечер, която обещава да овласти семействата с знания и мотивация относно цифровия живот на децата.

Разкриващи тайните на ролята на технологията в развитието на децата

Разбиране на въздействието на технологията върху децата

Докато технологията продължава да прониква във всеки аспект от живота ни, нейното влияние върху развитието на младежите е станало актуален проблем за родители, educators и общности. Boulder Country Day е в предната част на този разговор, организирайки значима презентация на 22 януари 2025 г. от 18:00 до 19:30 ч. Това безплатно събитие е открито за обществеността и има за цел да предостави на участниците знания, необходими за навигиране в сложността на дигиталната взаимодействия в съвременния свят.

Сесията ще представи Ерин Уолш, изтъкнат лектор и съосновател на Spark and Stitch Institute. Уолш предоставя богат опит, тъй като е работила с различни общности в цялата страна, за да се справи с развитието на децата в дигиталната ера. Нейният опит обхваща не само най-новите изследвания, но също така подчертава практически стратегии, които семействата могат да приложат, за да насърчат безопасна и обогатяваща онлайн среда.

Основни теми, разгледани в презентацията

Участниците могат да очакват ангажирано разглеждане на критични теми, като:

– Технология и социални връзки: Дълбочинно разглеждане на това дали технологията служи като мост за социална интеракция или води до увеличена изолация сред децата.

– Изследвания в областта на мозъчната наука: Информация относно това как дигиталното взаимодействие влияе на когнитивното развитие в различни възрастови групи, с особено внимание на деца на възраст от 2 до 13 години.

– Стратегии за дигитално благосъстояние: Уолш ще предложи конкретни съвети за насърчаване на здравословни цифрови навици и подобряване на благосъстоянието в технология-наситен свят.

Защитни фактори срещу онлайн рискове

Една от акцентите на това събитие ще бъде дискусия относно основните защитни фактори, които могат да защитят децата от потенциалните опасности на онлайн средата. Уолш ще представи стратегии за родители и educators, които насърчават безопасна интернет употреба, като същевременно развиват основни цифрови умения у младежите.

Регистрация и присъствие

За да си осигурите място на тази важна презентация, участниците се насърчават да се регистрират през сайта на Boulder Country Day. Това събитие обещава да овласти семействата, предоставяйки ценни прозрения и мотивация за подкрепа на децата в техния цифров живот.

Допълнителни прозрения за технологията и младежта

За да обогатите разбирането си по темата преди събитието, помислете да разгледате допълнителни ресурси, налични на Educate Tech. Тук ще намерите видеа и дискусии относно дигиталното благосъстояние, родителството в дигиталната ера и науката зад въздействието на технологията върху мозъците на децата.

Докато се приближаваме до 2025 г., разбирането на последствията от технологията върху развитието на децата само ще расте в значение. Тази презентация не е просто шанс да научите нещо ново, а и възможност да се включите в важен диалог, който може да оформи бъдещето на нашите деца в дигиталния свят.