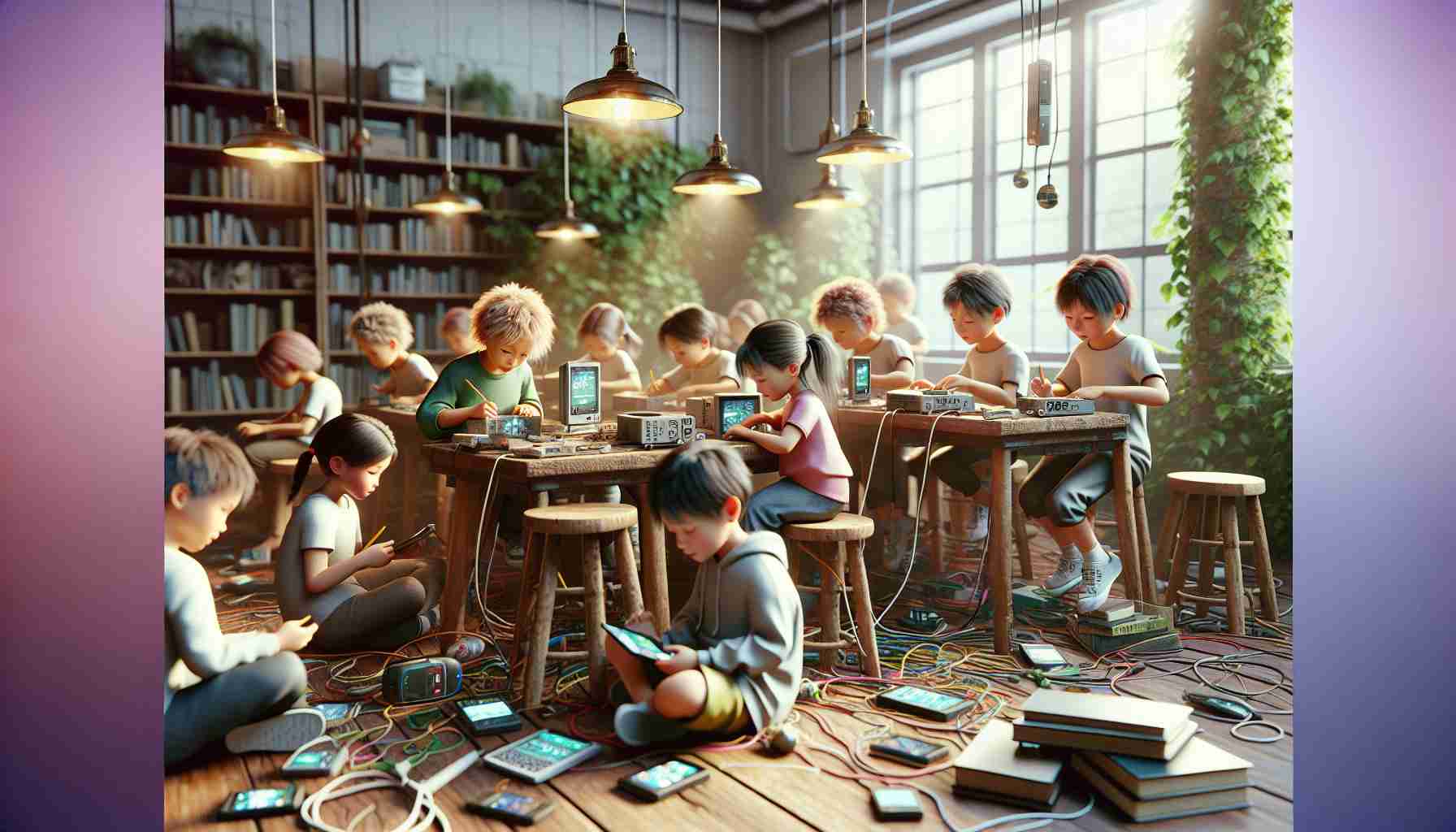

Compreendendo o Impacto da Tecnologia nas Crianças

A Boulder Country Day convida a comunidade para uma apresentação vital que esclarece a influência da tecnologia sobre as crianças. Agendada para 22 de janeiro de 2025, este evento informativo acontecerá das 18h às 19h30 e está aberto a todos, gratuitamente.

A sessão contará com Erin Walsh, uma palestrante renomada e cofundadora do Spark and Stitch Institute. Com base em sua vasta experiência, Walsh trabalhou com comunidades em todo o país, ajudando-as a lidar com as complexidades do desenvolvimento infantil e adolescente na era digital. Através de seu estilo envolvente, ela torna tópicos intrincados acessíveis, incentivando discussões perspicazes entre pais e educadores.

Os participantes podem esperar explorar perguntas intrigantes sobre o papel da tecnologia em promover conexões sociais ou fomentar o isolamento entre as crianças. Além disso, Walsh compartilhará as mais recentes pesquisas sobre ciência do cérebro e estratégias práticas voltadas para melhorar o bem-estar digital de jovens de 2 a 13 anos e mais.

Os participantes ganharão insights valiosos sobre fatores de proteção essenciais que podem ajudar a proteger as crianças dos riscos online, ao mesmo tempo em que nutrem suas habilidades digitais.

Para garantir um lugar nesta apresentação esclarecedora, a inscrição é recomendada através do site da Boulder Country Day. Junte-se a nós para uma noite que promete capacitar as famílias com conhecimento e motivação em relação à vida digital das crianças.

Desvendando os Segredos do Papel da Tecnologia no Desenvolvimento das Crianças

Compreendendo o Impacto da Tecnologia nas Crianças

À medida que a tecnologia continua a infiltrar-se em todos os aspectos de nossas vidas, seu impacto no desenvolvimento juvenil tornou-se uma preocupação premente para pais, educadores e comunidades. A Boulder Country Day está na vanguarda dessa conversa, hospedando uma apresentação significativa em 22 de janeiro de 2025, das 18h às 19h30. Este evento gratuito é aberto ao público e visa equipar os participantes com o conhecimento necessário para navegar pelas complexidades da interação digital no mundo atual.

A sessão contará com Erin Walsh, uma palestrante distinta e cofundadora do Spark and Stitch Institute. Walsh traz uma riqueza de experiência, pois trabalhou com várias comunidades em todo o país para abordar o desenvolvimento infantil na era digital. Sua experiência abrange não apenas as pesquisas mais recentes, mas também enfatiza estratégias práticas que as famílias podem empregar para promover um ambiente online seguro e enriquecedor.

Temas Principais Abordados na Apresentação

Os participantes podem esperar uma exploração envolvente de temas críticos, como:

– Tecnologia e Conexões Sociais: Uma análise aprofundada sobre se a tecnologia atua como uma ponte que favorece interações sociais ou se leva ao aumento do isolamento entre as crianças.

– Pesquisas em Ciência do Cérebro: Insights sobre como o engajamento digital impacta o desenvolvimento cognitivo em várias faixas etárias, com foco especial em crianças de 2 a 13 anos.

– Estratégias de Bem-Estar Digital: Walsh oferecerá dicas concretas sobre como promover hábitos digitais saudáveis e melhorar o bem-estar em um mundo saturado de tecnologia.

Fatores de Proteção Contra Riscos Online

Um dos destaques deste evento será uma discussão sobre fatores de proteção essenciais que podem proteger as crianças dos perigos potenciais do ambiente online. Walsh apresentará estratégias para pais e educadores que incentivam o uso seguro da internet, ao mesmo tempo em que nutrem habilidades digitais essenciais nos jovens.

Inscrição e Presença

Para garantir seu lugar nesta importante apresentação, os participantes são incentivados a se inscrever através do site da Boulder Country Day. Este evento promete capacitar as famílias, fornecendo insights valiosos e motivação para apoiar as crianças em suas vidas digitais.

Mais Insights sobre Tecnologia e Juventude

Para enriquecer sua compreensão sobre o tema antes do evento, considere explorar recursos adicionais disponíveis em Educate Tech. Aqui você encontrará vídeos e discussões sobre bem-estar digital, parentalidade na era digital e a ciência por trás dos efeitos da tecnologia nos cérebros das crianças.

À medida que nos aproximamos de 2025, compreender as implicações da tecnologia no desenvolvimento infantil se tornará cada vez mais significativo. Esta apresentação não é apenas uma chance de aprender, mas também uma oportunidade de engajar-se em um diálogo crucial que pode moldar o futuro de nossas crianças em um mundo digital.